The Silent Revolution in Logistics: Building the Unified Brain of Modern 3PLs

Every industry has its founding narratives. Tech has the garage. Finance has the crisis. Logistics has the spreadsheet named “FINAL_FINAL_v3”.

But picture this instead.

A logistics manager somewhere in North America opens ten dashboards before coffee, all calibrated to disagree on the same data. She

clicks through them with the practiced resignation of someone fluent in logistical static. WMS here, TMS there, freight system in another

tab, CRM operating on a completely separate timeline. Information everywhere, understanding nowhere.

Each login solves a single function while collectively generating operational drag.

The kind of architecture that emerges when each department solves its own problem in its own decade, leaving behind a digital archaeological site where WMS lives in the Bronze Age, TMS thinks it’s in 2014, and CRM behaves like it’s allergic to integration.

Everyone knows the joke: logistics doesn’t run on software, it runs on the people who remember where the software breaks.

“Global logistics has become a museum of siloed software stitched together by human patience.”

And here’s the part nobody admits out loud: For 3PLs, this fragmentation has quietly become the largest invisible tax on growth and the bill is now too large to ignore.

LogixGRID exists because the industry finally admitted the truth: the problem is not the people. It’s the ecosystem.

What follows is the anatomy of that ecosystem and the strategic realignment taking place among 3PLs who are tired of solving yesterday with yesterday’s tools.

The Communication Problem in a $100+ Billion Market

Imagine the scale. Every container, every shipment, every driver, and every consignee is a node in a massive, dynamic network. Every handoff, every status check, and every exception alert is a potential point of failure. The human element, while indispensable for strategy and problem-solving, can’t keep pace with this velocity.

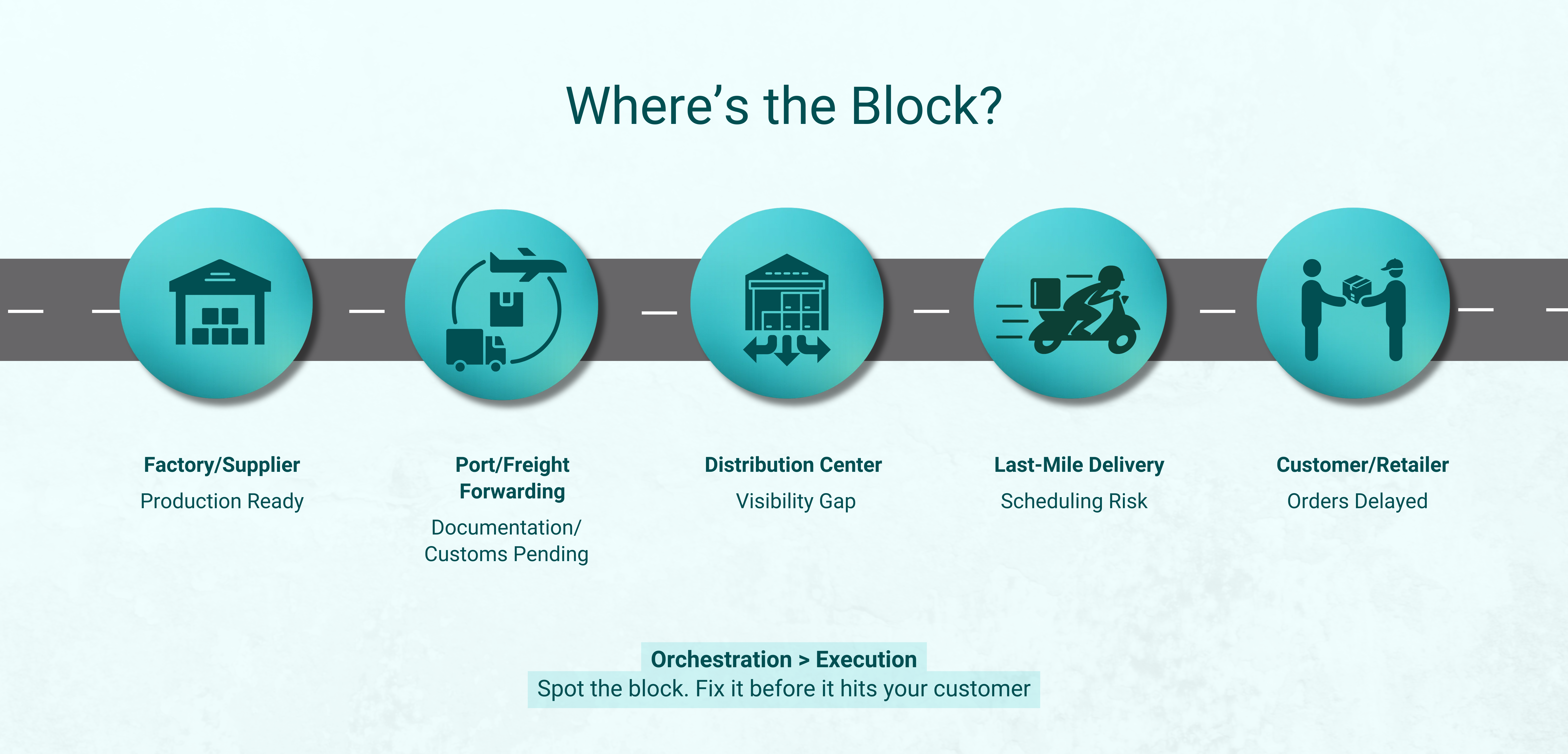

Here’s where the system often breaks:

- Vague or Late ETAs: A 2025 DHL shopper data report highlighted rising frustration among consumers, with 52% citing “long delivery times” as a pain point, up from 46% the previous year. Ambiguous or delayed updates compound this frustration, even if deliveries are technically on time.

- Port Dwell and Demurrage Fees: Poor communication about congestion can lead to costly, avoidable penalties. According to Container xChange’s 2023 report, the average two-week demurrage and detention fee is around US$1,219 per container. Without timely information, teams can’t act proactively to minimize these charges.

- Channel Mismatch: The GCC is a digital-first region, with near-universal social and messaging penetration, 100% active social IDs in the UAE, and 99.6% in Saudi Arabia. WhatsApp has become the lingua franca for communication, from drivers to BCOs. Updates buried in emails or portals risk invisibility.

- Manual Handoffs During Disruptions: When a critical event occurs at 2 a.m., a human drafting a notice at 9 a.m. introduces unnecessary delay. This slow response can cascade, compounding disruption and impacting downstream operations.

“In a market exceeding US$100 billion, communication efficiency determines profitability.”

Historically, trade and communication have always been intertwined. In the 19th century, telegraph networks revolutionized shipping by giving port operators real-time access to vessel movements. Today, AI is the modern telegraph, but infinitely faster, smarter and predictive.

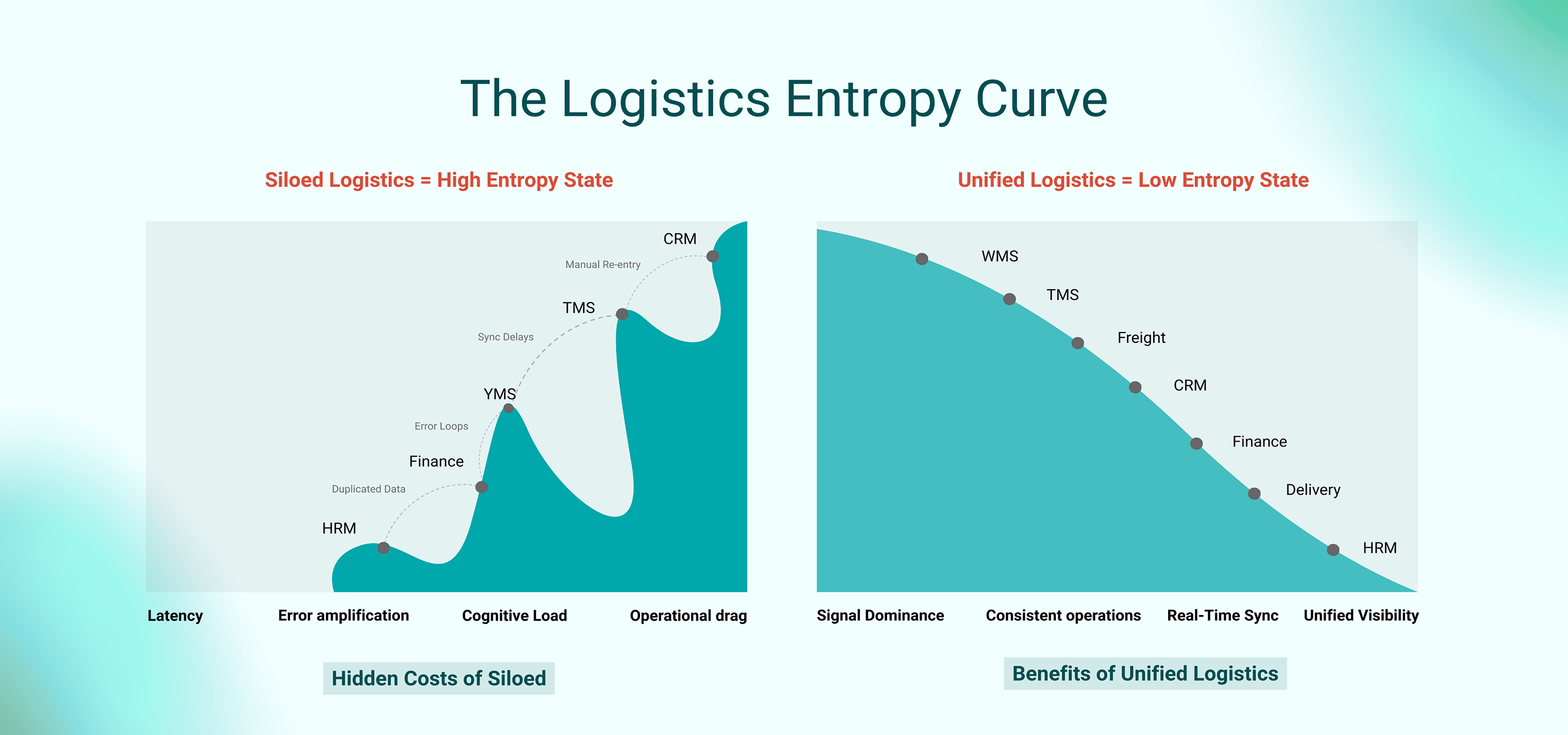

The Silo Paradox: More Software, Less Supply-Chain Intelligence

A typical 3PL today is a network of isolated subsystems: WMS, TMS, Freight Forwarding, YMS, fleet management, CRM, HRM, and finance systems all orbiting independently. None were designed to speak to each other out-of-the-box.

A 2024 logistics survey captured the industry’s collective sigh: integration with existing systems is the number one barrier to adopting new technology. The fragmentation is so widespread that even world-class 3PLs in Asia, Europe, and North America are slowing themselves down with duplicated data, manual reconciliation, and outdated decision frameworks.

You can see the paradox in action:

Means More Data

Means More Noise

Means Slower Decisions

Means Worse Performance.

The very tools meant to authorize logistics end up suffocating it.

Manhattan Associates summarized it plainly. Distribution, transportation, labor, and yard management often operate in silos, separate truths, separate timelines, separate blind spots. In this world, a customer tracking portal is only as accurate as the slowest, most isolated system behind it.

It is a structural risk.

Margin Leakage by Design: How Fragmentation Taxes Every Shipment

Siloed systems are expensive in the same way climate change is expensive: slowly, everywhere, and with disproportionate impact.

Teams become human middleware. Export from WMS. Re-enter into TMS. Copy to CRM. Re-check in a spreadsheet with a five percent error rate. Multiply that across clients, shifts, and months. This is operational entropy disguised as work.

“You cannot set up what you cannot see.”

Inventory visibility lags. Shipment issues surface hours late. Managers operate with stale data. Lumenalta’s finding is blunt: disruptions get sluggish responses that cost sales and inflate expenses.

Every manual transfer invites a domino chain of miscounts, wrong addresses, backorders, refunds, and quiet margin erosion.

Visibility becomes a luxury instead of a standard. Clients log into multiple systems. Customer teams chase information across departments. Trust evaporates.

Fragmentation forces companies to maintain overlapping systems, redundant databases, expensive integrations, and inflated safety stocks. CIO surveys reveal that 90 percent believe outdated systems block innovation. Consolidation, meanwhile, can cut IT and operational costs by up to 65 percent.

A Global Map of the Same Problem, Solved Differently

What makes the logistics industry uniquely interesting is that silos exist everywhere, but each region responds according to its economic patterning.

Asia Pacific

Fast growth created complicated system mosaics, yet the region is now a leader in digital unification. Dimerco’s integrated cloud system is a case study in real-time data flow, API transparency, and eliminating multi-portal fatigue for clients.

Middle East and MENA

Government-driven modernization pushes integration from the top. Saudi Arabia’s Fasah unified customs processes so effectively that clearance times fell from a week to hours. The region is leapfrogging incremental improvements and going straight to unified ecosystems.

Europe and Africa

Europe wrestles with legacy ERPs and country-specific systems but is steadily consolidating through cloud-native platforms. Africa’s younger logistics companies often skip legacy entirely, adopting integrated systems by default.

Latin America

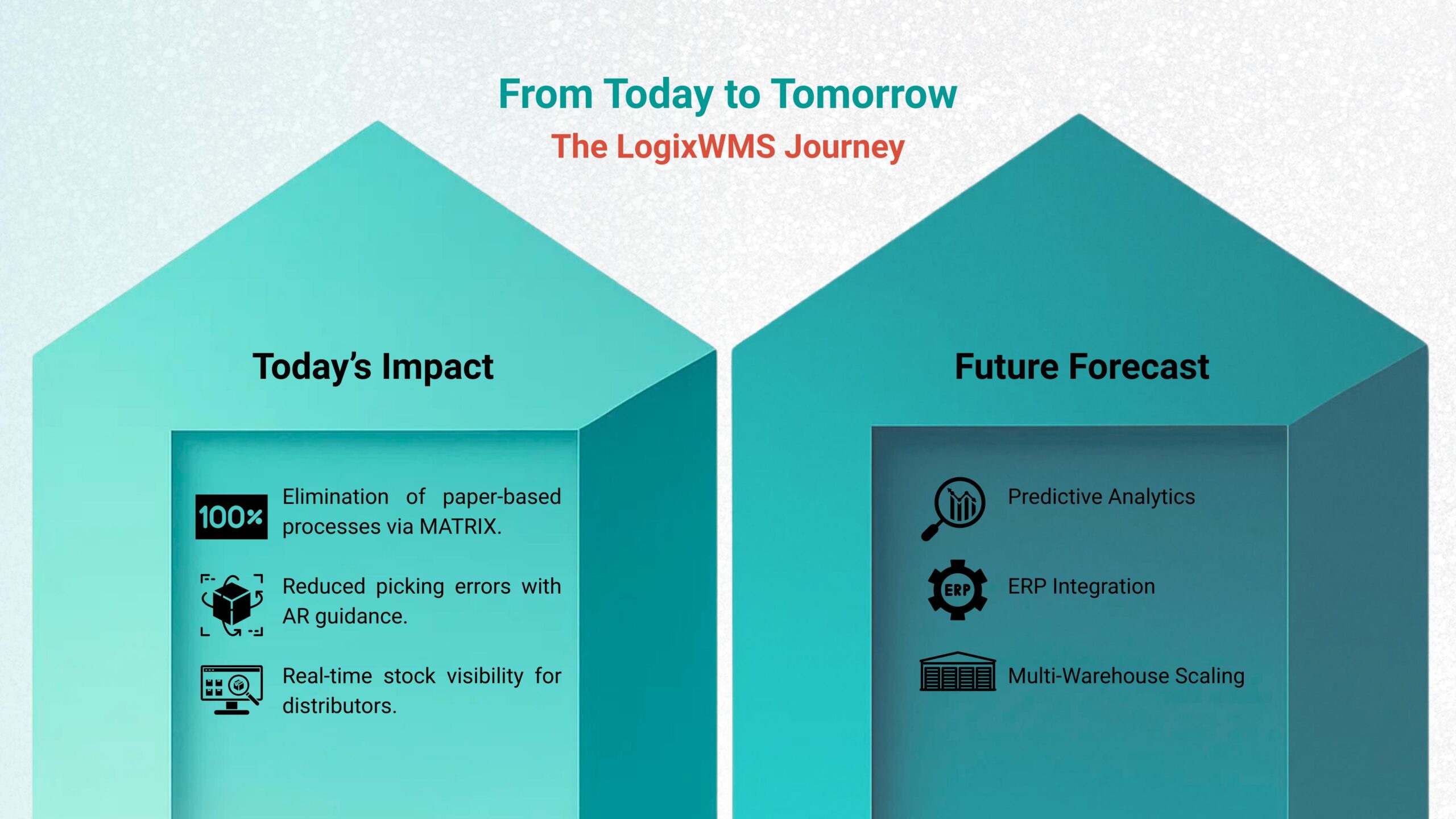

Transitioning rapidly under e-commerce pressure. A Brazilian distributor saw measurable improvements in communication, cost efficiency, and OTIF after moving from fragmented processes to a unified ERP.

North America

Ironically, some of the world’s most sophisticated 3PLs still face massive internal silos due to acquisitions and legacy infrastructure. Even here, 58 percent of 3PLs report integration challenges. Control towers and API-driven architectures are finally bridging the decades-old gaps.

How Leading 3PLs Are Engineering Their Escape From Silo Gravity

The strategic response to fragmentation falls into several patterns:

Replacing islands with a connected continent. DHL, Dimerco, and global leaders now run their operations on single, shared platforms where inventory, transport, and finance live in the same world.

For those who cannot replace systems, the solution is connectivity. Event-driven architecture, message buses, and APIs create a synchronized nervous system that unifies multiple tools.

Cloud-native logistics architectures reduce technical debt, accelerate innovation, and simplify scaling.

A unified system without unified behavior is still fragmented. High-performing 3PLs map flows, retrain teams, and build cross-functional operational intelligence.

Once data lives in one reality, AI, ML, and automation become possible. Not as terminology. As everyday accelerators of accuracy and throughput.

LogixGRID: The Platform That Turns Complexity Into Coherence

LogixGRID doesn’t arrive as a software provider. It arrives as the infrastructure beneath the infrastructure, the part of the stack that finally learns to think in full sentences.

An AI-powered logistics automation environment containing WMS, TMS, freight, CRM, finance, delivery, and more. All in one integrated, native data model. Warehouse updates instantly inform transport. Financials auto-sync. Clients and teams operate in the same truth-space.

A no-code creation engine that lets logistics companies build, customize, reshape, and evolve workflows without writing a line of code. Unique checklists, onboarding flows, SLAs, quality controls, custom validations. Built visually. Activated instantly.

Carrier networks. ERPs. E-commerce platforms. Accounting tools. All connected through plug-and-play connectors and APIs.

LogixGRID removes the need for digital duct tape. It replaces the archipelago with a unified continent.

If You Didn’t Skim, You Already Know the Answer

Most logistics conclusions wrap up with optimism.

This one does not.

This one asks a question.

Imagine a warehouse twenty years from now.

Everything is unified, automated, visible, predictable.

Now imagine walking into that warehouse and discovering something strange:

It feels quiet.

Not peaceful.

Not calm.

Quiet in the way a solved puzzle becomes quiet.

No redundant keystrokes.

No conflicting databases.

No midnight reconciliations.

No managers triangulating the truth between systems.

No customers calling because they see gaps before you do.

No operations team doing heroics that should not be necessary.

Just synchrony.

Just clarity.

Just logistics as its own intelligence.

That is the world LogixGRID is designing. Not louder, faster, or shinier.

Just coherent.

And coherence, in the end, is the highest form of sophistication.

Ready to Transform?

It’s simple: upgrade to LogixPlatform today. Move your logistics billing from manual, siloed, error-prone mess to automated, accurate, HASiL-compliant workflows across your entire operation.

Let us help you transform your invoicing, so your operations run smoother, your cash flows faster and your compliance is airtight.

FAQ’s

LogixGRID solves the growing problem of fragmentation across WMS, TMS, freight, CRM, finance, and other systems that operate in silos. These disconnected tools create duplicated work, slow decisions, inconsistent data, and major operational inefficiencies. LogixGRID unifies these systems into a single coherent platform so that logistics teams operate with one shared truth.

Fragmentation leads to duplicate data entry, delayed visibility, compounding errors, and poor customer experience. It increases operating costs due to redundant systems, inflated safety stock, and slow decision-making. The PDF states that this creates “margin leakage at scale,” quietly eroding profitability across every shipment.

Regions follow unique patterns:

- Asia Pacific leads in integrated cloud systems with real-time data flow.

- Middle East & MENA drive integration through government-led modernization.

- Europe & Africa steadily move toward cloud-native consolidation.

- Latin America accelerates unification under e-commerce growth.

- North America battles legacy silos from acquisitions but increasingly uses APIs and control towers.

Top 3PLs use:

- Unified ERP platforms

- API-driven integration

- Cloud migration

- Process redesign & team retraining

- Analytics, automation & AI

These strategies help them shift from reactive patching to predictive, systemwide intelligence.

LogixPlatform is a fully unified, AI-powered logistics operating environment where WMS, TMS, freight, CRM, delivery, and finance exist in one native data model.

LogixFlow is a no-code engine allowing companies to build custom workflows, SLAs, checklists, and validations without engineering. Together, they eliminate digital fragmentation and create operational coherence.