4PL Orchestration – Redefining the Future of Supply Chain Management Beyond 3PL

For years, we’ve all heard about 3PLs — the third-party logistics providers that keep goods moving through transportation, warehousing, and fulfillment. They’ve done their job well. But as supply chains grew borderless, layered, and data-hungry, execution alone wasn’t enough. Something bigger had to step in — a model that could see the entire chessboard. Enter Fourth-Party Logistics, or 4PL as we like to wink at it, ¡Hola!

In simple terms, 4PL is a supply chain integrator — it designs, orchestrates, and optimizes the entire network while coordinating multiple 3PLs, carriers, and systems through a control tower model.

Interestingly, the idea isn’t new. It traces back to the mid-1990s, when Procter & Gamble teamed up with Accenture to bring order to its sprawling logistics web. P&G didn’t just need more trucks or warehouses; it needed orchestration — one brain managing the entire operation. That collaboration quietly gave birth to what we now call the 4PL model.

Fast forward to today, and the same concept powers global giants like Maersk and DHL, who run multi-continent networks with real-time control, resilience, and transparency. Talk about a glow-up!

3PL vs 4PL: The Executive Contrast

If 3PLs are the skilled drivers, 4PLs are the air-traffic controllers. One executes; the other orchestrates.

- Scope: A 3PL handles specific functions — transport, warehousing, or distribution. A 4PL owns the entire strategy, designing and optimizing the ecosystem that multiple 3PLs operate within. It’s the difference between moving goods and moving a supply chain.

- Accountability: 3PLs are vendors; 4PLs are single points of accountability. For a shipper, that means one contract, one governance model, and one set of performance KPIs — even if ten different carriers and warehouses are in play. No more “who messed up?”.

- Asset Posture: Most 3PLs are asset-heavy. 4PLs stay asset-light, leveraging the right partners, carriers, and technology stacks for agility.

- Technology: 4PLs are built on control towers, unified data platforms, and AI-driven insights. They bring predictive visibility across the chain, highlighting risks before they turn into costs.

Substantially, 3PLs execute logistics; 4PLs engineer it. Yes, there’s a difference — and a big one.

Where 4PL Adds Value: The End-to-End Chain

- Order Collection (First Mile): Managing multiple vendor pickups, consolidating loads, routing intelligently, and implementing SLAs — all orchestrated by the 4PL while 3PL fleets execute, often powered by LogixDMS.

- Imports & Freight Forwarding: 4PLs run procurement of carriers, lane design, documentation, and compliance. Tools like FreightNX create optimized playbooks and audit freight for cost accuracy.

- Customs Brokerage: Through digital workflows, HS-code governance, and provider selection, 4PLs assure smooth clearance and data consistency, integrated with the control tower dashboard Alya/Analytics.

- Warehousing & Distribution: From designing DC networks to monitoring KPIs across third-party warehouses, the 4PL ensures products are stored and moved efficiently under LogixWMS guidance.

- Last-Mile Delivery: They optimize carrier mixes, monitor cost-to-serve analytics, and track OTIF (On-Time-In-Full) performance, turning delivery from a cost center into a differentiator, orchestrated via LogixDMS.

- Freight Bill Audit & Payment (FBAP): 4PLs validate contracts, rates, and accessorials, resolving disputes and automating payment workflows to reduce leakages.

- COD Oversight & Reconciliation: Especially in retail-heavy supply chains, 4PLs oversee cash-on-delivery processes, reconciliation, and reporting through control-tower dashboards like Alya/Analytics.

- 1. Commercials & Governance

4PL engagements are structured under a Master Services Agreement (MSA) linked to SLAs and OLAs. The pricing model ties directly to performance KPIs like OTIF, cost-to-serve, dispute rate, and dwell time. - Governance follows a cadence: weekly operational reviews, monthly performance dashboards, and quarterly network redesign sessions — aligning cost, service, and agility.

- 2. Control Tower & Data Foundation

At the heart of every 4PL lies the control tower — a multi-party data layer that integrates TMS, WMS, OMS, and carrier APIs. Exceptions are flagged automatically, not buried in spreadsheets.

A unified data model governs every entity — locations, SKUs, contracts, and partners — assuring consistency across systems. - 3. Resilience & AI

- AI models predict ETA deviations, flag disruption risks, and simulate scenarios, making supply chains proactive rather than reactive. Early-warning systems and what-if simulations drastically reduce expedite costs and disruptions. Basically, it thinks ahead so humans don’t have to panic later.

- 4. Sustainability

- Modern 4PLs embed sustainability by optimizing mode mix, consolidating loads, and tracking carbon intensity within the same control tower. ESG performance becomes measurable, not just aspirational.

- Perfect Order / OTIF

- Cost-to-Serve

- Inventory Turns

- Carbon Intensity

- Dwell Time

- Carrier Compliance

- Forecast Accuracy

- Exception Cycle Time

- Invoice Dispute Rate

- Syngenta × Maersk (4PL Partnership): A multi-year 4PL program where Maersk orchestrated Syngenta’s global logistics ecosystem. Their partnership renewal highlighted tangible value, visibility, network efficiency, and innovation.

- DHL LLP Programs: DHL’s Lead Logistics Provider (LLP) programs combine control towers and network redesigns. Using their SCI platform, they’ve driven cost reductions, compliance, and near real-time visibility across complex environments.

- Baseline lanes, costs, and SLAs

- Ingest contracts and data

- Connect top carriers

- Launch FBAP pilot on top-spend lanes

- Run carrier re-bids

- Publish milestone tracking across the chain (PO → origin → DC → delivery)

- Release KPI Dashboard v1

- Fix data quality gaps

- Expand FBAP coverage to 80%+ of spend

- Enable AI-driven ETA prediction

- Present network redesign options

- Deploy rapid custom workflows via LogixFlow

- Single-Provider Lock-In: Mandate open standards and data ownership clauses. The shipper should always own its data.

- Misaligned Incentives: Balance gain-share models with baseline guarantees and transparent scorecards.

- Black-Box Decisions: Demand transparency — both in how the control tower prioritizes decisions and how data flows are governed.

- Week 1–2: Discovery, lane baseline, KPI setup

- Week 3–4: Integrations and FBAP pilot (LogixTMS & FreightNX)

- Week 5–8: Vendor pickup orchestration (LogixDMS) and tower v1 (Alya/Analytics)

- Week 9–12: Customs, COD reconciliation, KPI cadence. Rapid workflow apps (LogixFlow)

Each stage represents a project bucket, connected by one data layer and governed by one accountability framework.

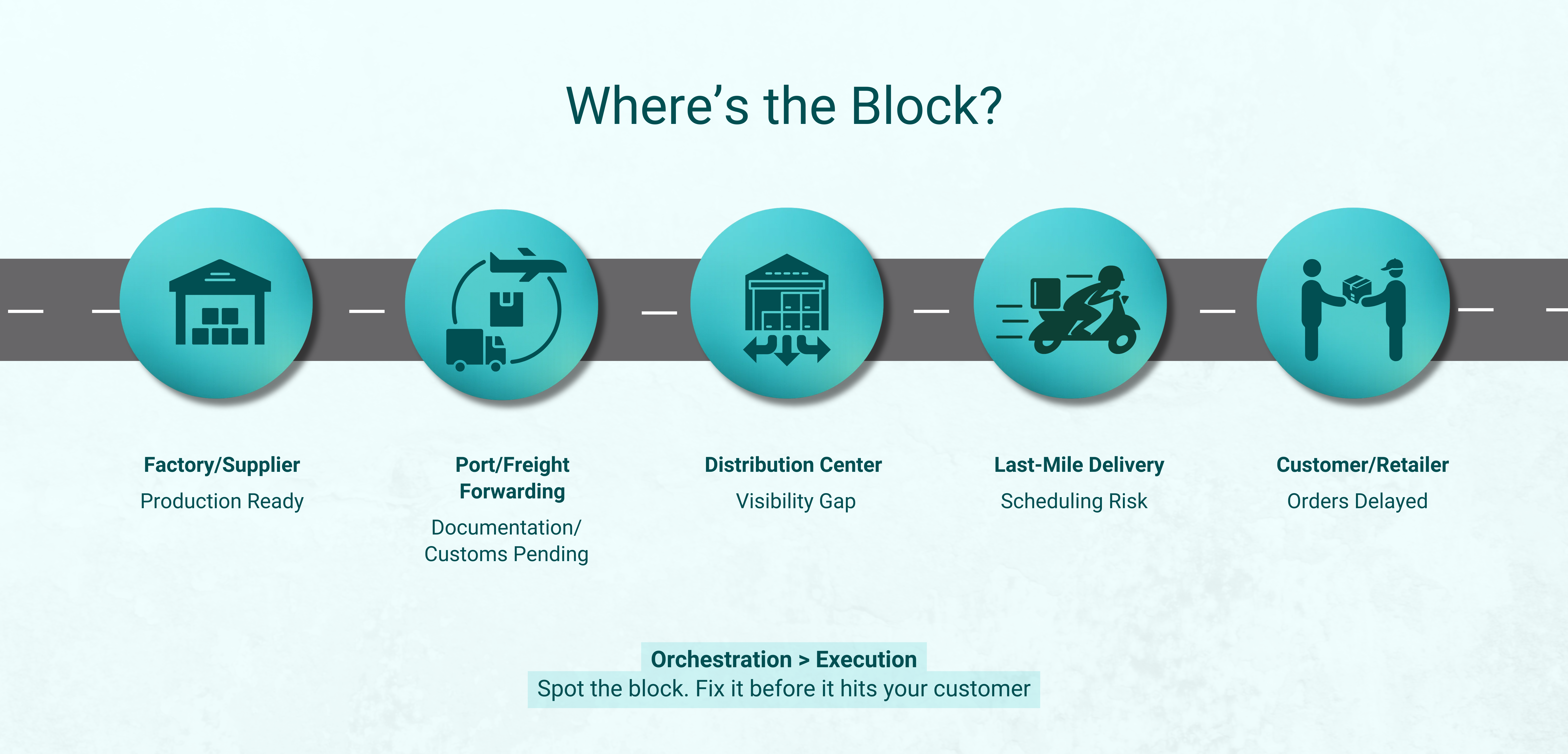

Spot the Block?

Let’s turn on our imagination: a shipper operates five 3PLs across Asia and Europe. Reports arrive weekly, often through spreadsheets. Inventory visibility lags by 48 hours. Freight disputes grow monthly. Customer service discovers delays only after the damage is done.

What’s missing here — better carriers, better tech, or better orchestration?

The missing piece is orchestration. That Aha! moment.

A 4PL connects every data source, aligns each partner under shared KPIs, and manages exceptions in real time — turning fragmented operations into one cohesive ecosystem.

Let’s take a closer look at a typical supply chain scenario, shall we? Notice where visibility gaps and delays create blockages and how orchestration could turn them into smooth flows.

Inside the 4PL Operating Model

The KPI Stack that Runs a 4PL

4PLs measure not just how goods move, but how intelligently they move.

Executive KPIs:

Operational KPIs:

These metrics don’t sit in silos — they’re interconnected. When dwell time drops, OTIF improves. When cost-to-serve aligns with carrier compliance, the network gains velocity.

What “Good” Looks Like: Case Studies

These aren’t isolated examples, they’re evidence that 4PL models deliver both savings and strategy (sometimes sanity too!).

The 90-Day Playbook to Stand Up a 4PL

Days 0-30:

Days 31-60:

Days 61-90:

In three months, a shipper can evolve from scattered data and siloed vendors to an orchestrated, measurable, and resilient logistics network.

Risks and How to Ease Them

4PLs succeed when trust is contractual, not just relational.

FAQ: How 4PL Solves Common Supply Chain Challenges

| Common Challenge | Traditional Approach | 4PL Outcome |

|---|---|---|

| First-mile pickups from multiple vendors | Each 3PL handles separately; coordination relies on manual follow-ups | 4PL designs and governs pickup routes, consolidates shipments, enforces SLAs, executed via managed 3PL fleets |

| Imports & freight forwarding complexity | Shipper or 3PL manages carriers individually; documentation often fragmented | 4PL orchestrates carrier procurement, lane design, compliance, and exception playbooks for seamless movement |

| Customs brokerage inefficiencies | Handled per shipment with inconsistent data; delays common | 4PL selects providers, enforces HS-code governance, and streamlines digital documentation workflows |

| Warehouse & DC network blind spots | 3PLs operate independently; inventory visibility limited | 4PL optimizes network design, strategically places inventory, and governs 3PL KPIs for efficiency |

| Last-mile delivery delays | Carriers selected by proximity or cost; reactive management | 4PL optimizes carrier mix, leverages cost-to-serve analytics, and manages OTIF performance proactively |

| Freight bill disputes & payment delays | Manual audits; slow dispute resolution | 4PL validates contracts/rates, handles accessorials, automates dispute resolution, and streamlines payment workflows |

| Payment collection / COD reconciliation gaps | Carrier-led collections; inconsistent reporting | 4PL defines policies, enables carriers, reconciles payments, and provides consolidated reporting via control tower |

| Lack of end-to-end visibility and predictive insight | Relies on periodic reports; reactive problem-solving | 4PL integrates multi-party data, runs exception-based workflows, and delivers predictive ETAs and KPI dashboards |

| Difficulty improving resilience without increasing cost | Expedited shipments, manual intervention, fragmented visibility | 4PL uses unified data, scenario planning, and early-warning systems to reduce disruptions while maintaining cost efficiency |

| Unclear ROI from 3PLs / fragmented accountability | Multiple vendors with separate KPIs; shipper struggles to measure impact | 4PL provides a single point of accountability, aligning all partners under shared KPIs and transparent governance |

Implementation Blueprint:

With a platform like LogixPlatform, companies don’t just adopt a 4PL model, they operationalize it.

4PL transforms traditional challenges into predictable outcomes, from first-mile pickups to last-mile delivery, governance and orchestration replace guesswork with measurable impact.

Where the Industry is Headed

4PL isn’t a replacement for 3PLs — it’s their evolution. As supply chains stretch across continents and data replaces guesswork, the orchestration layer becomes non-negotiable.

In the coming decade, every large enterprise will run a control tower, every logistics network will be data-governed, and every decision will hinge on predictive intelligence.The 4PL model isn’t a luxury anymore — it’s the foundation of modern logistics resilience.

And those who embrace it early — with the right mix of partners, platforms, and purpose — will be the ones shaping the global logistics map of tomorrow.