Manage your logistics/transportation more efficiently. Implement new technology to survive in competitive supply chain industry.

Contact now for free demo.

Sales@logixgrid.com

Manage your logistics/transportation more efficiently. Implement new technology to survive in competitive supply chain industry.

Contact now for free demo.

Sales@logixgrid.com

Prepare your Logistics business to get the advantage of GST India

Prepare your Logistics business to get the advantage of GST India

Schedule a free demo to get to know the evolving opportunities in #Logistics business. We ensure your productive time.

contact – sales@logixgrid.com

Schedule a free demo to get to know the evolving opportunities in #Logistics business. We ensure your productive time.

contact – sales@logixgrid.com

An online TMS platform allows you to stay in control of your business wherever you are.

The Most Economical Solution Is Here –

Contact – sales@logixgrid.com

Well Indian aviation policy 2016 also recognized that domestic and international air freight or air cargo and express logistics would be helpful to reduce or subsidize the passenger air fare.

Following are the few facts of Huge Upcoming Air Cargo Scopes :

Innovations are very important in this sector, as the demand is always for more reach and faster shipping at lower costs. The companies will need to invest in automation, while utilizing existing resources well.

Some of the new initiatives should be taken by air express operators :

Currently, air cargo volumes in India are very low as compared to other leading countries due to high charges and high turnaround time.

Presently, there is a very low level of air cargo penetration characterized by only a few airports equipped to handle large volumes of express delivery parcels. As the e-commerce gathers momentum and moves to the several less populated cities like tier 2 and tier 3, there will be increasing demand of expanding air cargo connectivity to smaller towns. The industry would invest in about $8 billion by 2025.

India set a benchmark in providing the lower cost services irrespective of any specific field still India has higher logistics cost due to various issues and challenges faced by the industry. India is involved in complex tax structure, the industry is also affected by poor rate of customs efficiency of clearance processes and procedures thus affecting the international export logistics stratum. however, insignificant comfort provided by the existing Indian infrastructure combined with lack of implementation of efficient IT-enabled tracking and tracing operation has saturated the efficiency of logistics and transportation.

The proposed goods and services tax (GST) will help companies reduce logistics cost by 1.5 to 2.5% as they reconfigure their supply chains and bring in three key structural changes to the logistics industry. First, as India becomes one big market, there will be fewer and larger warehouses. Second, it will lead to a larger number of bigger trucks on road as there is greater adoption of the hub-and-spoke model. Third, these changes will lead to greater economies of scale for transport operators and lead to more companies outsourcing their logistics operations.

Eliminating delays at check posts will yield an additional savings of 0.4-0.8% of sales. These cost savings are, however, more likely to be gradual and back ended, as corporate will have to realign their supply chain while ensuring minimum business disruption, it added. The impact of GST in logistics is going to be dramatic and revolutionary.

Interstate tax burden Currently, each of India’s 29 states taxes goods that move across their borders at different rates apart from that Corporate state tax of 2% is imposed for inter-state goods transfer. Not applicable. Uniform taxation and no varying tax structures would be allowed across states.

Currently, there are around 20-30 warehouses per company, one in every state, in addition to this 20-30 Carry & Forwarding agent per state making the supply chain longer and inefficient. GST tax will be imposed on transportation of goods and full credit will be available on interstate transactions.

Logistic costs are expected to be decreased by 1.5- 2.00% of sales on account of optimization of warehouses leading to lower inventory costs which are set up across states to avoid paying 2% corporate sales tax and phasing out of interstate sales tax. There is immense scope for optimization of costs.

The planned GST system seeks to replace multiple taxes and tariffs for a single tax at the point of sale. GST will unleash a new era of developing logistics infrastructure and take investments to the next level. The regulatory reforms proposed in the GST presents an opportunity to re-engineer logistics and transportation networks. Current inefficient and longer supply chains with warehouses in almost every state will now change based on delivery and cost efficiency. GST, when implemented, will free the decisions on warehousing and distribution from tax considerations and here the technology will play its role in the following cases –

This will result in more efficient cross-state transportation with improvement in transit time. Reformation of paperwork for road transporters Cost efficiency to optimum use of assets. This will lead to changes in Logistics Network Redefinition. Logistics service providers to rethink their business operations.

Simple plan to reduce logistics cost – Gov’s Biggest Approach

Transport management system – Why need a business software?

Secret of manufacturing warehouse management system – Case Study

Logistics Management System – Track Shipments Live On Website

FMCG Distribution Software – Instant billing and delivery on field

Omni literally means ‘all’ which would be told other way multiple. Multiple-channel logistics is highly related with the retailing. Its an experience of shopping focusing on customer’s comfort including analysis before purchase.

Traditional distribution process and line-up which were built around consumers of earlier time, people who used to shop almost exclusively at store and shopping malls and for them online delivery in 3-4 days would have been expected but new age shopping experience is being changed. People who will shop more online especially on mobile-phone and expect same day delivery or click and collect within an hour.

Below factors of supply chain, which can full-fill the promise of omni-channel logistics model profitably.

The Omni-channel consumer wants to use all channels simultaneously and retailers using an Omni-channel approach must track customer behavior across all these channels. In the Omni-channel retail model, customers demand a seamless shopping experience where they can order-from-anywhere, requiring retailers to adopt a ‘fulfill from-anywhere’ model.

But integrating the various points of purchase is only half the battle. To successfully execute omni-channel marketing, retailers need to integrate their distribution methods as well. With more consumers expecting a seamless experience, retail success today requires one system for offering online order processing and delivering customer orders, online pick-up location as well as tracking buying patterns.

In e-commerce-oriented distribution centers, products are picked from warehouse shelves at the direction of distribution workers. Those workers may also determine the best size of the box for shipping a multiple-item order and which packing materials are needed. If the customer has ordered gift-wrapping, distribution workers handle that, too.

Combining the two types of distribution strategies into one requires a new type of product and not only in terms of size.

The real core—and challenge—of Omni-channel is about the fulfilment. What happens behinds the scenes, the consequences of decisions and precision (or not) in execution become delightfully or painfully aware to the customer.

The end consumer is changing, too. Today, they are more interested in understanding the game of supply chain. They want fulfilment their way. They want to understand the source market—where it was made, the labour and other practices of the manufacturer, and so on.

Shop online, pickup in store (click-and-collect)— If the customer chooses pickup in store, that might be coming from the retailer’s own stock. But what if that is being shipped by the supplier? What if then the customer decides they don’t want the product? If it is not a standard stock item in the store, who owns that product now—the retailer or the supplier? Is this now a return and shipped back to the supplier? One system logistics technology can resolve everything in one click.

Customize and deliver—Consumers often visit a store to configure or design their personal version of a product. The level of these orders coming through e-commerce channels has significantly increased. Although the retailer may be the sales channel, the question becomes who executes the logistics and services associated with the order. This exposes a fundamental question of the supplier/retailer relationship and their traditional roles. Technology has been shaped in a mobile-device now to build such relationship between supplier and retailer.

More frequent orders—Suppliers may have to ship from warehouse to the store more frequently and and frequent orders may be small in amount. Thus suppliers may need more stock in ‘sales ready’ inventory. This may change their pick/pack/shipping operations or warehouse design to support consumer-oriented orders. This sort of inventory projection, accounting should be automated and technological help is the best way to figure it out.

Then there’s a huge opportunity for having a much broader selection Omni-channel, speed of delivery, selection, those are the opportunities today. And unfortunately, retailers need to work on several of those. They can’t just do one of those well because there are different perspectives and they need to make sure they really do well on all of those.

CIO-review-magazine-2015-top-promising-company.

CIO- presented-June 2016 – focusing on Logistics & Transportation Technology.

Reference : http://goo.gl/3sI0k3 page no. 19

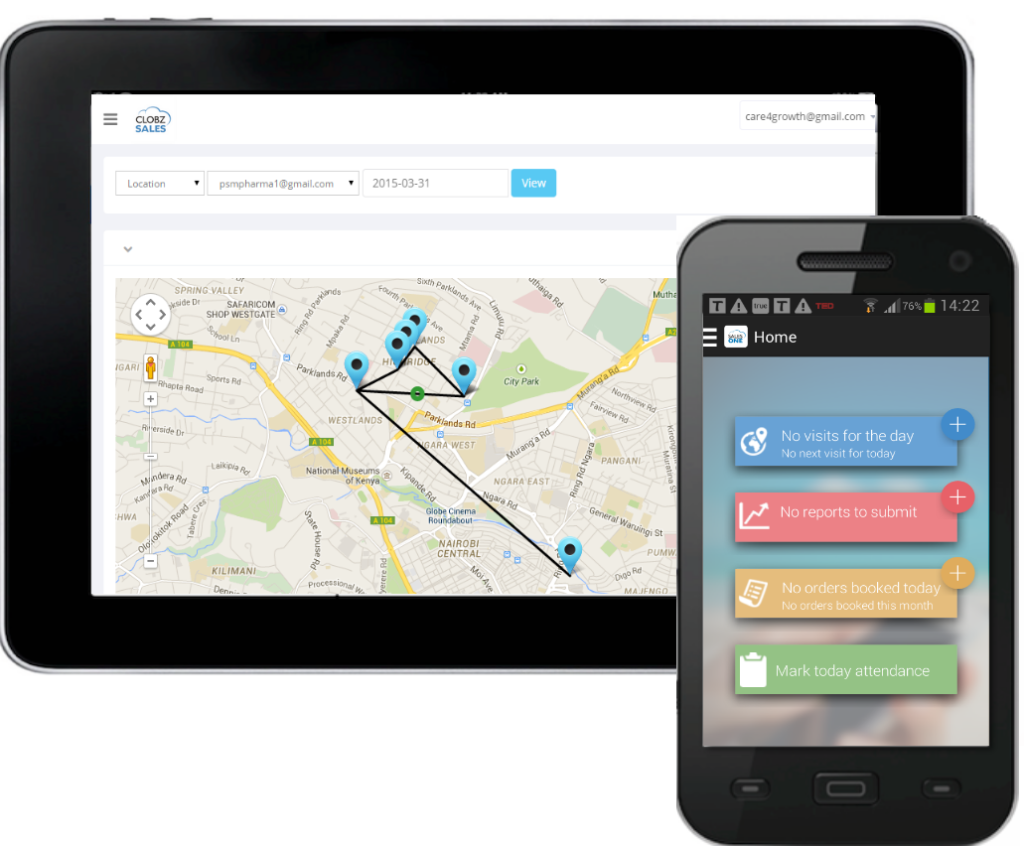

A next generation solution to automate sales and other enterprise activities has been claimed to be the most economical solution to increase the productivity of the sales team. Clobz Sales Force Automation system helps to coordinate the interdependent activities of marketing, selling, and providing service, and the information that these systems contain can help senior executives make sales-related decisions.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |